The Coronavirus Aid, Relief and Economic Security (CARES) Act (H.R. 748), approved by Congress on March 27, 2020, includes a number of economic supports that will immediately help America’s workers. (PDF Link)

Childcare Funding

$3.5 billion (a 50% increase) in funding for the Childcare Development Block Grant.

- This money will be available to states to provide free childcare to “first responders” including grocery stores workers, drug store workers, health care workers, police, firefighters, and other workers deemed essential during the response to the coronavirus.

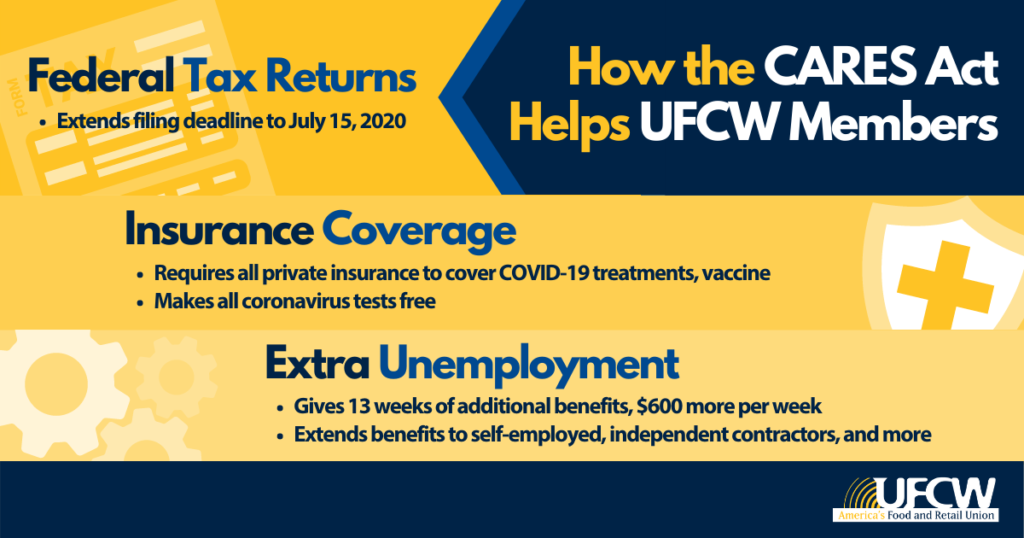

Extra Unemployment

The bill makes major changes to unemployment assistance, increasing the benefits and broadening who is eligible. States will still continue to pay unemployment to people who qualify. The benefit amount and amount of time people can collect the benefit varies state by state. The bill:

- Adds $600 per week in benefits to everyone receiving UI

- Adds 13 weeks of additional benefits – which also applies to those currently receiving unemployment.

- Includes benefits for those who traditionally were ineligible for unemployment (self-employed workers, independent contractors, those with limited work history, etc.)

Tax Returns

Some people have not filed their 2019 tax returns, but that’s OK. The filing deadline has been extended to July 15.

- The IRS also says that people who have filed or plan to can still expect to receive a refund if they are owed one.

Insurance Coverage

The bill requires all private insurance plans to cover COVID-19 treatments and vaccine and makes all coronavirus tests free.

Additional information can be found by visiting the AFL-CIO’s State Resources website at https://aflcio.org/covid-19/state-resources and the National Employment Law Project’s fact sheet at https://s27147.pcdn.co/wp-content/uploads/Fact-Sheet-Unemployment-Insurance-Provisions-CARES-Act.pdf